We all need to be very conscientious of what the unintended consequences might be from the extraordinary monetary and fiscal policy responses due to the COVID-19 crisis. Never before have we seen this much money printing, this much manipulation of the financial system, this much government spending, and this much government debt being created at once.

Many experts are saying this could cause runaway inflation at some point. Historically, during periods of inflation, you want to own hard assets like real estate and precious metals and avoid things like bonds and cash savings. Even stocks have had mixed performances during inflationary environments. Because they are typically priced in relation to bonds and bonds are priced relative to inflation, if inflation goes up, this means the yields on bonds and stocks must go up to compensate. And the only way to increase the yield on something is for the price to go down. Some stocks may be able to grow their earnings in line with or even faster than inflation which means they might be good investments. But the market as a whole probably won't keep up with inflation given how high stock valuations are (and thus how low stock yields are) today.

This has a lot more people looking into precious metals and even Bitcoin as a way to preserve their savings since the supply is limited. And at least for precious metals, there is millennia of historical precedent that when governments get wild with spending and printing, precious metals are the best way to preserve wealth.

However, not every precious metal should be thought of equally. Similar to exchange rates between countries, the price of each precious metal should be compared to each other to see if there are any pricing anomalies. Right now, there are major pricing anomalies going on.

You see, gold is the favored precious metal in these types of situations because of all that history proving it can hold value. So people are buying gold right now and the price is moving up quickly. However, when you compare the price of gold to the price of silver and platinum, you will see that gold is approaching all time highs whereas silver and platinum are at historically cheap levels.

As of July 6, 2020, the price of gold was $1785 per ounce, the price of platinum was $18 per ounce, and the price of platinum was $825 per ounce. So doing some ratios, gold is trading at 100 times the price of silver and 2 times the price of platinum. Let's put these ratios in historical perspective.

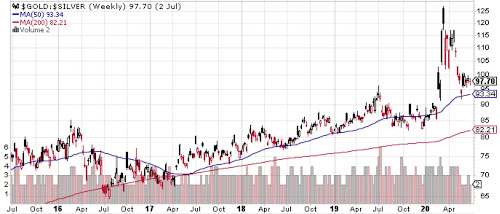

These two charts depict the historical and recent ratios of gold to silver. You can see for centuries going back to the 1700s, the price of gold to silver held steady at just below 20 ounces of silver to 1 ounce of gold. Then in the 1930's during the Great Depression, the ratio shot up to nearly 100 as the gold standard was adjusted in response to the financial collapse. Then silver strengthened and gold weakened and the ratio dropped back to around 20. Then the ratio shot back up again to over 80 in the late 70s when Nixon completely eliminated the gold standard from the U.S. Dollar.

Now the gold to silver ratio has shot up again and recently reached an time high of 125 in mid-March at the height of the COVID-19 crisis. This has dropped some to 100 as the price of silver has been increasing faster than gold in recent weeks, but it is still at historical highs. This is like finding a once in a century investing opportunity.

The same things is happening for platinum. Platinum is arguably the better metal. It is more rare than gold (30 times rarer in fact), it is stronger and less prone to scratches or bending, it is the preferred jewelry metal, and it has industrial uses like in reducing carbon emissions.

Therefore, you'd think platinum would trade for at least the price of gold, and that is the case for most of history. Platinum even reached over 2 times the price of gold in the 90's and 2000's. But now it trades at half the price of gold. You can see from the chart below, this has never happened in the past 5 decades. There are some market forces going on with car manufacturing, EVs rising, and pricing of platinum's cousin palladium that have resulted in platinum's price being impacted. All these things are short term aberrations that are likely not to hold in the near future. So again like silver, this is looking like a once in a lifetime opportunity to invest in platinum based on the value it has today to gold.

There is an awesomely simple investing strategy that involves investing in silver and platinum when they are cheap and then switching to gold when the ratios reach more normal levels. Below is an example using silver. The idea is you buy silver when the ratio is 80 or higher like it is today. Then when the ratio gets back to 45-50, you sell your silver and use the proceeds to buy gold. Then hold gold until the ratio gets back to 80 or higher and switch back to silver.

In this example which depicts the strategy in place from 1985, you can see you would have grown 8,000 oz of silver into 45,000 oz of silver. That's an increase of over 5 times without having to invest any more money! In gold terms, you would have started with 100 oz of gold and now have 450 oz worth of gold in silver, and this is likely to become even more gold as the ratio comes back down to historical levels. In USD terms, you would have invested about $32,000 back in 1985 to buy 100 oz of gold and today would have the equivalent of $810,000 worth of silver! This is an incredible 25x increase in wealth!

Had you invested in the S&P 500 over that time and reinvested all dividends, you would have achieved a 43x increase in wealth so this strategy does lag the U.S. stock market. But on price alone, the S&P 500 has only increased 18 times over that period ($170 at the start of 1985 and is now at $3,100). So this strategy does unbelievably well considering you are investing in real assets, not stock certificates!

The knock from experts (even Warren Buffett) from investing in precious metals is that it just sits there and earns nothing, so why not invest it in a company where you have a shot at earning something. Well, this strategy proves there is a way to actually earn something on your gold, silver, and platinum investments simply by paying attention to their historical price ratios and trading between them when they reach extremes. It is best to do this using a tax deferred account like an IRA so that way there aren't any tax implications from trading out of one precious metal and into another.

My favorite way to invest in gold, silver, and platinum is by using the Aberdeen Standard precious metal ETFs. The tickers are:

- SGOL for Gold - $2 billion in assets; expense of 0.17%

- SIVR for Silver - $490 million in assets; expense of 0.30%

- PPLT for Platinum - $675 million in assets; expense of 0.60%

What I like about these compared to other popular gold and silver ETFs is that they actually own, store, and regularly account for the precious metals. They don't create new shares without having actual new precious metals in their possession. This adds a level of security that if things really got squirrelly in the financial system, you know that their are real assets there and not just paper stock certificates.

This is not a recommendation or financial advice, just general education. Please consult with a financial advisor and perform your own research before making any investments.

Comments

Post a Comment